Real moves to lower carbon use in Asia

- By Shamshad Akhtar

0 Comment(s)

0 Comment(s) Print

Print E-mail Shanghai Daily, October 21, 2014

E-mail Shanghai Daily, October 21, 2014

|

|

|

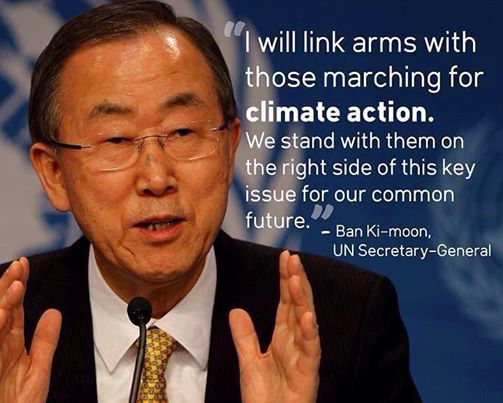

The landmark climate summit convened by the United Nations secretary-general last month in New York was unprecedented. |

The landmark climate summit convened by the United Nations secretary-general last month in New York was unprecedented in terms of the participation of leaders, the private sector and a range of other stakeholders.

The level and scale of enthusiasm it generated augurs well for global climate action and for future generations. This new momentum must now translate into real action in Asia and the Pacific.

Leaders at the summit offered commitments that will feed into the UN Climate Change Conference to be held in Paris next year. Some categorically committed to cut emissions and called for greater action to limit the rise in global temperatures to less than 2 degrees Celsius.

Initial commitments at the summit for the capitalization of the Green Climate Fund amounted to more than US$2.3 billion, with new multi-stakeholder partnerships registered for low-carbon and climate-resilient development finance, amounting to almost US$200 billion.

It’s a good start, but much more is needed. To support the public commitments, calls have been made for greater engagement by financial institutions, the insurance sector and institutional investors, who hold enormous global and regional savings that can service the risk and long-term capital requirements of climate-adaptation and mitigation projects.

The summit also overwhelmingly supported carbon pricing as a tool to reduce emissions and to improve sustainability, as well as economic growth prospects.

Equally heartening were the cross-sectoral, multi-stakeholder coalitions that emerged, from the Global Agricultural Alliance to secure food for rapidly growing populations to the dozens of governments, businesses, civil society groups and indigenous peoples who pledged to end deforestation by 2030.