China 'Going global' picks up speed

- By John Ross

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, March 2, 2013

E-mail China.org.cn, March 2, 2013

![[By Jiao Haiyang/China.org.cn] [By Jiao Haiyang/China.org.cn]](http://images.china.cn/attachement/jpg/site1007/20130301/001ec949c22b129a654317.jpg) |

|

[By Jiao Haiyang/China.org.cn] |

Chinese companies "going global" attract increasing attention. Even U.S. regulators, after earlier difficulties, now approve significant acquisitions by Chinese companies. Industrial and Commercial Bank of China (ICBC) achieved China's first takeover of a U.S. bank by purchasing Bank of East Asia, and approval was received for China National Offshore Oil Corporation taking over Canadian energy company Nexen and China's automotive components manufacturer Wanxiang purchasing U.S. battery maker A123.

However, parallel discussion of globalization by China's companies run in numerous directions. One is sensationalist reporting such as The Economist magazine's cover "Who's Afraid of Huawei?" and U.S. Congressional hearings on that company and China's other telecoms giant ZTE. Publishers issue books with titles such as "Is China Buying the World?" But Mthuli Ncube, chief economist of the African Development Bank, recently wrote that China's investment in African countries was potentially "the biggest opportunity in their history."

The reason for such interest is evident. China is the world's second largest economy and likely to become the largest within a decade. It is the world's largest goods exporter and second largest importer. But China is only just starting to carry out major outward foreign direct investment (FDI).

As recently as 2003 China's annual outward FDI was only US$2.9bn, 0.5 percent of the world total. By 2011, the latest year for which full global data is available, China's outward FDI was US$65.1bn. The figure for the first 11 months of 2012 was US$62.5bn, a 25 percent growth over the same period in 2011. China's outward FDI in 2011 was 2,300 percent of its level in 2003, compared to the EU's 150 percent, the U.S.'s 300 percent, or Japan's 400 percent. Little wonder China's FDI attracts attention!

But it is necessary to keep a strict sense of proportion. China's outward FDI in 2011 was only 4.3 percent of the global total compared to 7.5 percent for Japan, 26.0 percent for the U.S. and 27.6 percent for the EU. China's Ministry of Commerce target of US$150bn in 2015 would still be under half the US$397bn the U.S. invested abroad in 2011, and only slightly over a third of the EU's US$420bn. While in some industries China has major outward FDI, in many others constraints prevent China's outward FDI rapidly assuming large dimensions.

The strength powering China's outward FDI is its huge financial resources. China's annual finance available for investment, its savings, is US$3.6tr compared to the U.S.'s US$1.8tr. China's US$3.3tr foreign exchange reserves are the world's largest. But it takes time to translate this financial strength into equivalent company scale. China's companies, except in a few industries, are not yet as large as international competitors and FDI usually, although not invariably, requires greater resources than operating in a company's own country.

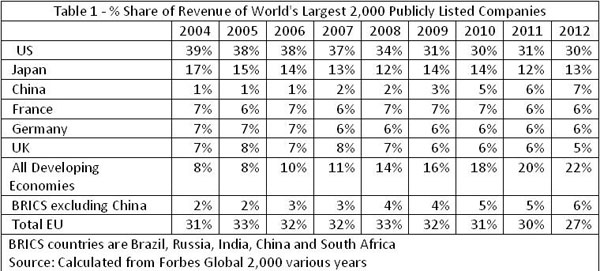

To show the position of China's companies in international competition, and therefore their realistic potential to "go global", Table 1 gives the percentage of revenue of the major economies in the world's largest 2,000 publicly listed companies. These companies' turnover is equivalent to half world GDP – a much larger sample than the sometimes quoted Fortune 500.