Take care to let in private capital

- By Yi Xianrong

0 Comment(s)

0 Comment(s) Print

Print E-mail China.org.cn, March 31, 2012

E-mail China.org.cn, March 31, 2012

Backed by the nation's regulations on supporting the development of the private economic sector and facing lasting difficulties in financing by small- and medium-sized enterprises (SMEs), there have been rising demands, both in and out of the government, for more incorporation of private capitals into Chinese banks. However, these decisions must be made cautiously, or things could go out of control and put China's financial market at risk.

|

|

|

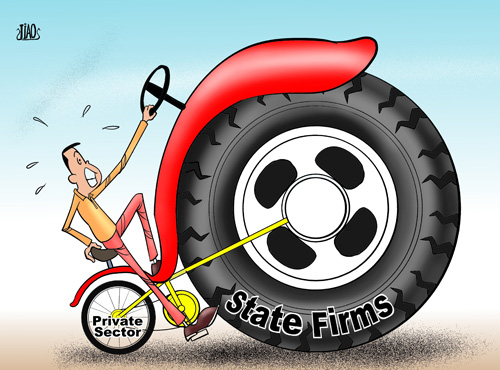

Uneven development [By Jiao Haiyang/China.org.cn] |

First, we should consider the reasons why private capital should be incorporated into the bank sector. Will this encourage competition in the market? In my opinion, as long as the government controls interest rates and credit ceilings, a system of market economy cannot be established regardless of whether the bank's lending capital is public or private. In other words, whether the government could ease regulation is essential to driving competition in the financial market.

The second question is whether private capital could solve the financing difficulties faced by SMEs or businesses in rural areas. This is actually a challenge that exists worldwide, which cannot be solved by market economy mechanisms. Assuming private capital is allowed to enter community banks, will it be used to finance SMEs without regulation? Sadly, answer is no, and the many reasons include low profit margins and their lack of a sound and feasible business structure.

From that perspective, it is clear that the fundamental motive for private capital to enter the banking sector, which is currently monopolized by the state, is profit. This is understandable especially considering that China's banking industry saw considerable profits last year.

For this reason, we must be cautious in giving access to private capital. Because it lacks credit guarantee, the central bank must provide insurance for deposits and loans. This will enable private banks to pursue high returns by giving loans to high-risk projects, all the while transferring these risks to the government and the society. What's worse, internet banking makes it much easier for people in charge of the banks to use the savings deposits for unauthorized purposes or even run off them. Based on past experiences, these risks could be even higher than currently estimated.

Finally, is the development of U.S. community banks a good model for China? In the history of the U.S., banking crises have been a common occurrence mainly due to fierce competition among banks forcing them to cut corners and exploit the system. On the contrary, under protection and strict oversight and supervision by the government, the banking system in Canada has been relatively stable.

China should take a closer look at the root causes of U.S. financial crises, possibly realizing that the U.S. model is not always the right one to follow.

Accounting for the function of private capital that is neither to establish market competition nor to solve SMEs' difficulties financing, the question becomes how much value we should give to private banks. We should ponder carefully whether its inclusion in the financial market will benefit the future of China's banking industry.

The author is a researcher with the Institute of Finance and Banking under the Chinese Academy of Social Sciences.

(This article was first published in Chinese and translated by Guo Jiali.)

Opinion articles reflect the views of their authors, not necessarily those of China.org.cn.