| Home / Business / Finance | Tools: Save | Print | E-mail | Most Read | Comment |

| Security Key Issue in China's ATM War |

| Adjust font size: |

Following the central bank's go-ahead, Chinese banks have recently raised the limit of ATM withdrawal from 5,000 yuan to 20,000 yuan. But customers can still withdraw just 2,000 to 3,000 yuan per transaction, the same as before. In cases of inter-bank transactions, account holders are charged a 2-yuan service fee per transaction. This means customers need to conduct at least seven transactions to withdraw the maximum amount and pay more than 14 yuan in service fees.

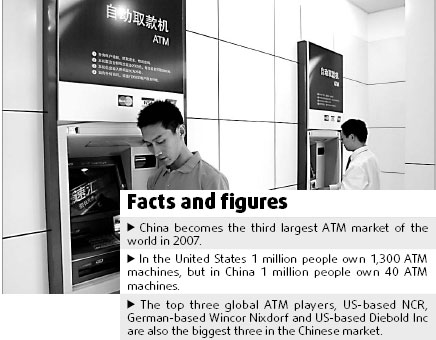

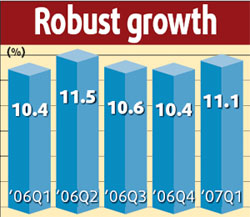

There is also a rising security risk as a result of the increase of withdrawal limit as most ATMs are located outside the bank buildings. As more foreign banks are set to enter China, Chinese banks will be increasingly competing on services more than ever before, and ATMs are seen as a way of attracting and retaining customers. Bank customers want convenient, comfortable and safe service, and security remains their primary concern as bankcard frauds and card counterfeiting are increasingly a problem. The China Banking Regulatory Commission issued a risk warning last week, reminding customers not to leak their bankcard information. Officials said more efforts are needed to intensify the security measures and improve ATM services. According to officials, all 3,000-plus ATMs in Beijing will be equipped with a face-recognition system and be hooked onto a police emergency response network within the year to detect criminal suspects and prevent cash withdrawal frauds. Ian Selbie, director of the Risk Management Department of Unisys Asia Pacific, said Chinese banks should take more rigorous risk prevention measures with their ATM businesses to curb rampant card fraud and counterfeit notes. Unisys is a US-based information technology services and solutions company. Besides ramping up efforts to upgrade their self-service systems, Chinese banks should apply more solutions tailored to the changing demands of their customers, Selbie added. Quality service will be one of the key factors for Chinese banks to get better prepared for fiercer competition from foreign banks. Upgrading technologies is another pressing task. China is ranked first in the world in terms of bankcard business growth, according to statistics from the central bank's science and technology department. China's ATMs are mainly made and operated by global players. The biggest three in the Chinese market are US-based NCR, Germany-based Wincor Nixdorf and US-based Diebold Inc. These major players are all striving for better services and increased security this year, rather than more products although they are under huge pressure as a result of a nationwide surge in demand. NCR has set up a currency data processing center in Beijing to help combat counterfeiting. Each time a new note is introduced into circulation by the central bank, its authenticity is identified by the NCR data base then stored in a software template that enables ATMs to recognize it as genuine. According to NCR officials, a technology update is essential to ensure that every ATM transaction is accurate. Upgrading technology and setting up upgraded ATM channels will be a key competitive point to gain more consumers. "Chinese banks can't be satisfied with simply supplying equipment. Instead, they want comprehensive services in self-service equipment and operation. Security and upgrading technology are our top obligations," said Zhu Zhi Cheng, CEO of FinTronics, a Hong Kong-listed ATM maker and operator. FinTronics has business relationships with more than 20 local banks. Australia-based ATM company Customers Ltd, which acquired the controlling stakes of FinTronics, plans to flex its muscle in China's ATM battlefield. Executive chairman of Australian ATM giant, Greg Baker, predicted ATM machines in China would double to 180,000 units in three to five years There are about 40 ATMs per 1 million people in China, compared with more than 1,000 per 1 million in the US. (China Daily July 10 2007) |

| Tools: Save | Print | E-mail | Most Read |

| Comment |

|

| Related Stories |

|