Owning a piece of art

Shares in China's first art portfolio to be listed on the Shenzhen Culture Assets and Equity Exchange sold on their first day of issue earlier this month, for a total 2.4 million yuan ($354,480), creating what the share issuers predict to be a new trend in the art-trading field.

|

|

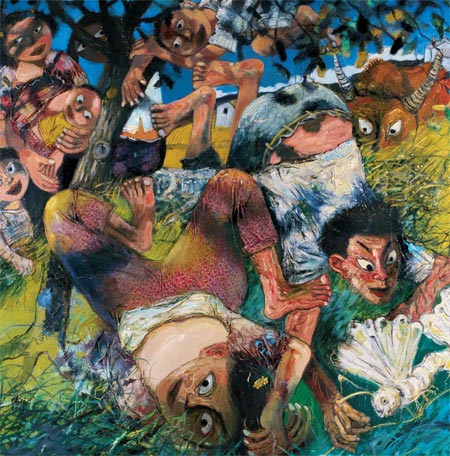

Xiangcun Yuyan (Village Fable) by Yang Peijiang, one part of the first art portfolio. [Global Times] |

The 1,000-share portfolio consists of 12 paintings by famous Chinese artist Yang Peijiang. Issuer, Shenzhen Artvip Culture Corporation, is the first art dealer authorized by the exchange to issue such shares and along with Yang's agent Zhang Hong, holds 40 percent of the portfolio, Ye Qiang, Artvip's board chairman, told the Global Times. The rest of the shares were purchased by art collectors, dealers and financial organizations, Ye said.

"The artwork portfolio is something new. The emergence of such portfolios are conducive to the integration of resources, which will benefit not only art dealers but also collectors and financial agencies," Yang Jun, deputy director of the Artwork Evaluation Commission of the Culture Market Development Center of China's Culture Ministry, told the Global Times.

Although there are no detailed schedules for the issue of more portfolios, Artvip has already prepared several for the future, also featuring calligraphic works and paintings by contemporary artists, such as those from the China Central Academy of Fine Arts and promising artists Li Aiguo and Peng Youshan, Ye said.

The division of a portfolio's ownership and profits means that investors can own part of a work and reap profits according to the shares they buy, Ye explained, adding that the benefits include both short and long term gains.

"Investors of our first artwork portfolio are upbeat about the market and its future," Ye commented. "The buyers who are keen on the artistic value of Yang's works regard the portfolio as a new model in which to invest in his works. They are happy to own even part of a work. For sheer investors, they are also very interested in the model and investing."

According to Ye, Yang's portfolio has an estimated market value of 6 million yuan ($886,200); however, the total value of shares issued in the portfolio was 2.4 million yuan. "This is one of the pricing strategies. At the moment, the market lacks a fair evaluation system. We did this because we wanted to leave some space for the value to increase."

Yang Jun explained that the launch of such a portfolio onto the market means that more people can invest in and appreciate artwork. "As the market is still in its infancy, more substantial and valuable artworks will enter the market," he predicted.

Besides calligraphic works and paintings, other artworks such as ceramics and jade, especially those from the Yuan (1279-1368), Ming (1368-1644) and Qing (1644-1911) dynasties and antique furniture can also be sold in portfolios, Yang said.

"As they are non-renewable, all artworks that have contemporary art value can be sold in portfolios… Artworks are not cultural relics and only via circulation can their values be maximized," he pointed out.

In spite of the expanding art market in China, experts have also warned investors of the potential risks when investing in such a product.

"They need to have some basic knowledge about the market and be aware of the risks," said Hu Hao, manager of the exchange office at the Shenzhen Culture Assets and Equity Exchange.

"The works don't have to be works by modern or contemporary artists...The most important thing is that they are genuine and have a big potential to increase in value," he said.

As for the Chinese art market, Yang said it is in urgent need of regulating.

"At the moment, buyers can't have their money back even if they buy something fake from art dealers and the dealers are not responsible for that. Even at auction, you can't guarantee all works are original. Therefore, art collectors need to improve their evaluation skills to verify artworks and we need laws and regulations to offer a legal framework to protect buyers," he said.

0

0